Featured

Tibetan Monk Takes Life Following Torture

Tenzin Dorjee’s death took place in 2023 but has only now come to light

Featured

Tenzin Dorjee’s death took place in 2023 but has only now come to light

Featured

Chinese authorities are continuing to enforce a crackdown on Tibetan language teaching across Tibet.

Featured

Tibetan locals and monks have been protesting the construction of a new dam that would destroy their homes and monasteries.

Hydropower station threatens displacement of Atsok Monastery after government revokes its cultural relic protection status

Police have been deployed across Ngaba and around Kirti Monastery following Pema’s protest

In December, Gonmo Kyi and her husband Choekyong were arbitrarily detained, beaten and denied hospital access following a peaceful protest

Ludup under police watch and without access to medical care after release from prison

A retrospective on the 10 March protest and celebrations in London from Free Tibet's Jules Falavigna.

Tenzin Khernrab has been in detention for over a year with police refusing to provide any information to his mother Phudé

Tenzin Khenrab’s mother is alone and in worsening health due to the lack of information

New report reveals chilling effect of China’s weaponisation of big data in Tibet.

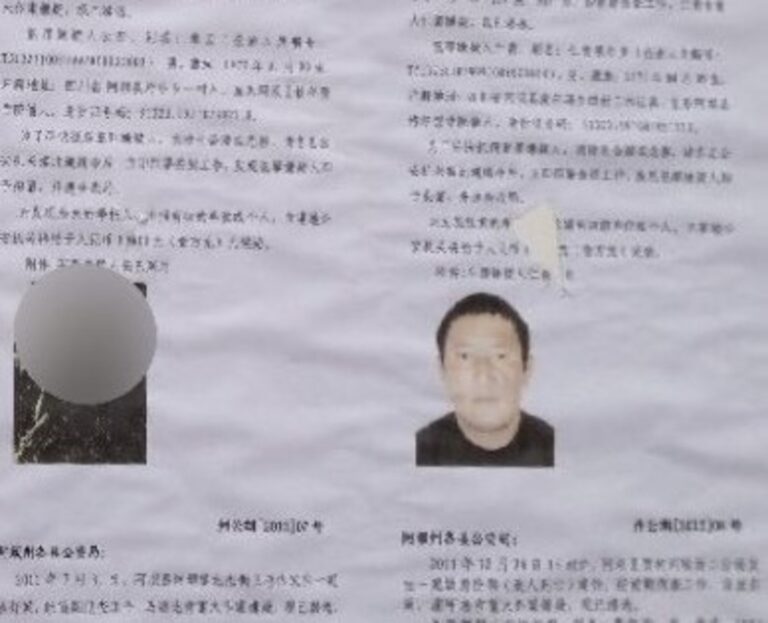

Palden held in incommunicado detention by police in Pema County following court verdict